August 11, 2021

An Examination of Farmland Performance During Four US Recessions

On Monday, July 19, the National Bureau of Economic Research declared that the Covid-19 recession, which began dramatically in March 2020, officially ended in April 2020. The two-month downturn is the shortest recession on record.

Although the recession technically ended more than a year ago, the economy seems far from “normal.” The stock market continues to hit record highs, although many question how long these gains are sustainable. Volatility has persisted across asset classes, including stocks, gold and cryptocurrency.

In these uncertain times, many investors are searching for safe haven investments that enable preservation of capital while continuing to generate returns. One newly available safe haven investment is farmland. Read on to learn more about how farmland investments have performed during four recent recessions and what this illustrates about the benefits of farmland investing in uncertain economic times.

1980s Recession and Inflation

In 1981 - 1982, the US was plunged into the worst recession since the Great Depression. The recession was caused by tightening monetary policy as the Fed attempted to curb persistent double-digit inflation. This was on top of a weak economy, which had yet to recover from the 1980 recession, and ongoing high unemployment, which reached 11% by June 1979.

Investors during this time had few places to turn. The stock market experienced negative returns in 1981. In addition, real returns on bonds were negative due to high inflation. As a result of the inflationary environment, many investors poured money into gold, which peaked at $850/oz in January 1980 and then rapidly declined again in 1981.

The inflationary environment impacted farmland as well. Strong grain prices in the late ‘70s and early ‘80s led to a flood of borrowing among farmers. From 1981 - 1983, grain exports fell nearly 20%, driven by a strong dollar, a production glut and President Carter’s Soviet Grain Embargo. Falling prices, high inflation and increased production costs caused a significant decline in farmland values, which in turn made it difficult for farmers to service their high levels of debt. The wave of farm bankruptcies led to the first decline in farmland values since the Great Depression.

There are several key takeaways from the 1981 - 1982 recession. First, farmland leverage is now based on cash flow rather than underlying land value, which has led to much more prudent debt-to-asset ratios today than in the 1980s. Second, we are currently in a radically different inflation environment today than we were forty years ago. Even though the CPI experienced its biggest increase in 13 years over the past 12 months, very few experts believe we are anywhere close to returning to the inflation of the 1980s.

Sources: Farmland = TIAA-CREF Center for Farmland Research, Stocks = S&P500, Bonds = US Barclays Bond Agg, Gold = Spot, Real Estate = NCREIF

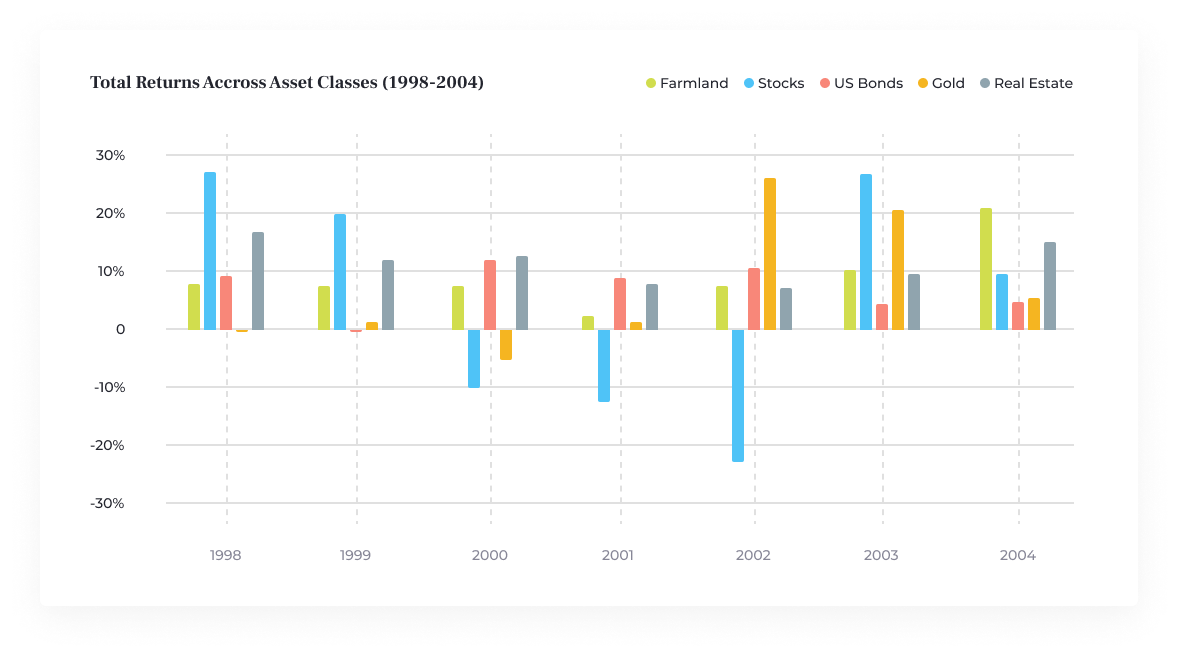

Early 2000’s DotCom Bubble and 9/11

In the early 2000s, the collapse of the dotcom bubble, the 9/11 terrorist attacks and a series of accounting scandals at major public corporations caused a modest recession. The Fed kept interest rates at historic lows (0.75% - 1.0%) in an attempt to combat ongoing unemployment. From an investor perspective, the stock market plummeted, and investors would have lost over 40% of their holdings between 2000 and 2002. The price of gold was also extremely volatile due to fear around Y2K. In contrast, bonds provided consistent and safe returns, while real estate continued to experience strong returns leading up to the 2007 - 2008 bubble.

During this time period, farmland produced strong, positive returns, supported by the wider trend of rising real estate prices. The value of farmland was also supported by low interest rates, which allowed for cheaper borrowing and easier repayments.

This recession illustrated the benefits of farmland as a safe haven investment. Like gold, farmland is a good store of value during economically uncertain times. Unlike gold, however, farmland experiences extremely low volatility. An additional benefit of farmland over gold is that farmland produces passive income.

Sources: Farmland = NCREIF, Stocks = S&P500, Bonds = US Barclays Bond Agg, Gold = Spot, Real Estate = NCREIF

2008 Financial Crisis

The 2008 Financial Crisis was kicked off by the collapse of the housing bubble, which set off a chain of events throughout the financial system. Unemployment reached as high as 10% in 2009. Several major financial institutions went bankrupt, and the Fed bailed out many others. Quantitative easing and rate cuts led to persistently low interest rates.

Stocks and real estate experienced double-digit losses in 2008 and 2009. Investors flocked to the security of gold and government bonds, even turning TBill yields briefly negative. From the beginning of 2007 to the end of 2009, gold increased in value by 60%.

Over this same period, farmland returns increased by nearly 30%. As was the case in the early 2000s, low interest rates significantly improved farmers’ balance sheets. High commodity prices also supported elevated farmland values. That being said, the decrease in real estate prices had an impact on farm values in some parts of the country, particularly the Northeast. By and large, however, farmland proved to be an excellent investment.

The financial crisis illustrated that although farmland has some similarities to more mainstream real estate classes, its behavior is distinct. The decline in real estate prices did not lead to a widespread corresponding decrease in farmland value. It was also very clear from this recession that farmland is uncorrelated with the equity market. Finally, the 2008-2009 Financial Crisis underscored that low rates are positive for farmers.

Sources: Farmland = NCREIF, Stocks = S&P 500, Bonds = US Barclays Bond Agg, Gold = Spot, Real Estate = NCREIF

Covid-19 Pandemic

The most recent recession began in March 2020, when the global economy ground to a halt as governments attempted to stem the spread of the Covid-19 virus. These shutdowns and the resulting panic led to a rapid crash of the stock market, although stocks rebounded nearly as quickly in response to rapid government stimulus. The recession officially ended in April 2020, making it the shortest recession on record.

Volatility was the norm across asset classes. At the beginning of the pandemic, gold prices dropped by 4%, while the value of Bitcoin dropped by nearly 50% in a single day. Bitcoin, gold and stocks have all rebounded, although volatility continues to be the norm. Real estate returns were weak due to the impact of Covid-related business closures and changes in consumer behavior; the long-term impact of these changes is unknown.

Farmland also experienced low or negative returns during this time due to several factors including supply chain disruptions, reduced demand for biofuel, low commodity prices, labor shortages and the ongoing trade war with China. Returns in 2020 and 2021 were almost entirely derived from income, with little or nothing coming from price appreciation.

The ongoing Covid-19 pandemic has highlighted several characteristics of farmland. First, the sector is by no means homogenous. Farmland returns were disproportionately impacted by a handful of US regions and crops. More importantly, however, the pandemic has illustrated the importance of farmland’s two income streams: despite little or no appreciation, investors benefited from ongoing cash payments. Finally, this period has highlighted farmland’s value as a safe haven investment with extremely low volatility.

Sources: Farmland = NCREIF Farmland Index, Stocks = S&P500, Bonds = US Barclays Bond Agg, Gold = Spot, Real Estate = NCREIF

Farmland Investing During A Recession

These case studies illustrate that farmland investments tend to perform well in a recession. The low volatility of farmland means that investors avoid the whiplash-inducing swings in value experienced by the stock market and gold, and even periods of negative returns tend to be low in contrast to major stock market losses.

Click here to see farmland's historical performance, visit our FAQ to learn more about investing with FarmTogether, or get started today by visiting ways to invest.

Disclaimer: FarmTogether is not a registered broker-dealer, investment advisor or investment manager. FarmTogether does not provide tax, legal or investment advice. This material has been prepared for informational and educational purposes only. You should consult your own tax, legal and investment advisors before engaging in any transaction.

Was this article helpful?