September 08, 2020

The Benefits of Adding Alternative Investments To Your Portfolio

A diversified portfolio is important for building long-term wealth. Diversification reduces overall portfolio volatility, minimizes losses due to market shocks, such as the volatility seen this year related to COVID-19, and improves returns over the medium- to long-term.

A portfolio can be diversified by investing in a variety of stocks, bonds and/or other products linked to public markets. For even more diversification, though, investors should consider alternative investments. Expanding your investments beyond traditional stocks and bonds offers several benefits. Let’s dive right into it.

What are alternative investments?

Alternative investments, or “alternatives,” are investments in any asset class other than stocks, bonds or cash. The term covers a broad range of assets, including everything from private equity and hedge funds to gold, real estate or farmland – even a collection of rare wine or stamps.

Institutional investors and high net worth individuals have relied on alternative investments to diversify their portfolios for decades. Yale University currently has a whopping 77% of its endowment allocated outside of traditional investments. A survey conducted by Nataxis earlier this year of over 500 institutional investors found that 71% thought the returns offered by alternative investments made them worth the potential liquidity risk, and a majority of investors planned on increasing their allocation of alternatives.

Thanks to innovative investment platforms like FarmTogether, alternative investments that were once inaccessible to the average accredited investor are now available to those who lack the deep pockets of Yale or the Rockefellers. The question remains: are they right for your portfolio?

What are the benefits of alternative investments?

Compared to traditional investments, alternative investments offer several benefits:

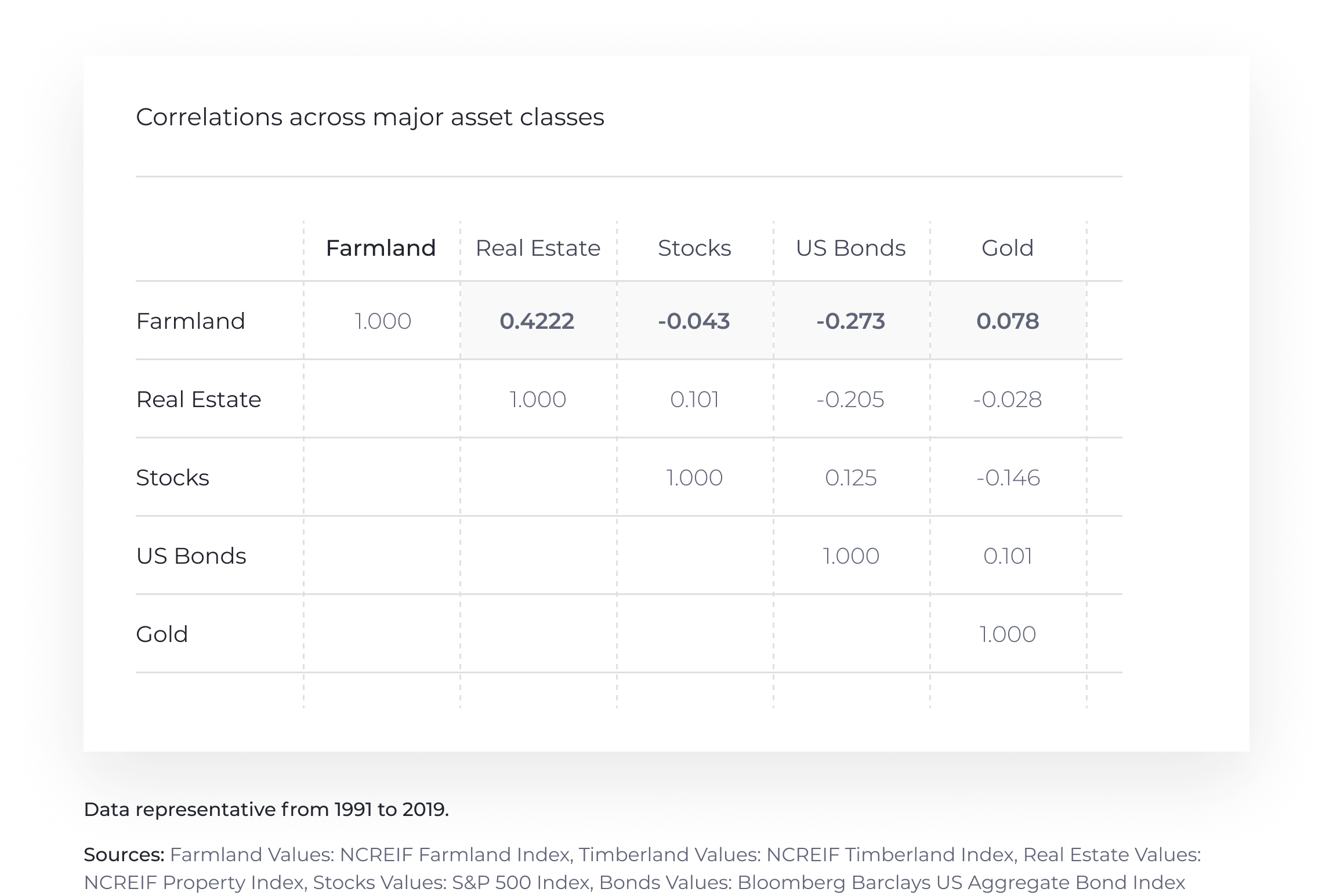

Diversification: First and foremost, the performance of alternative investments is not correlated with the performance of public markets. Adding alternatives to a diversified portfolio makes it more stable and less susceptible to swings in the market.

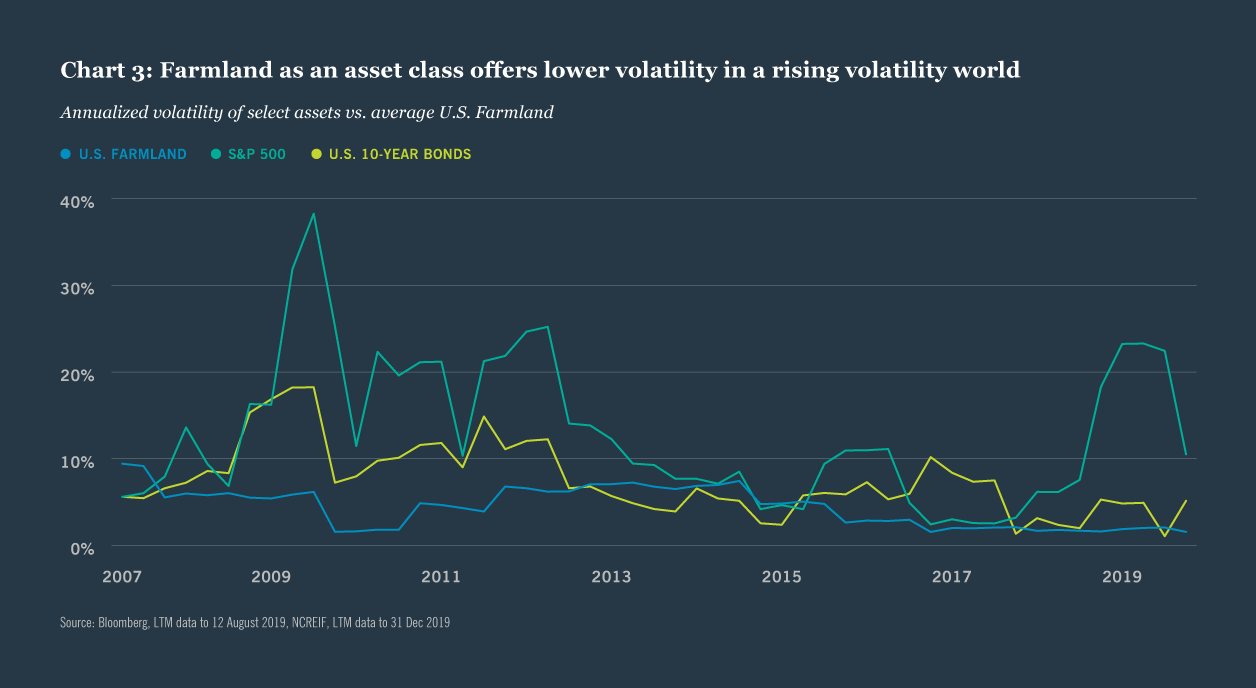

Less Volatility: Many alternative investments are less volatile than stocks, making them a good choice for investors in search of portfolio stability. For example, over the past twenty years, farmland has been less volatile than both the stock market and commercial real estate and had positive returns every single year.

Better Returns: Many alternative investments offer a higher rate of return than traditional investments. As can be seen from the chart below, farmland, timberland and real estate all outperformed the S&P 500 over a 20-year period. Farmland has consistently demonstrated strong absolute returns over the past few years. Between 1992 and 2018, it averaged ~10% total annual returns, including income and price appreciation.

Passive Income: For individual investors, many alternative investments have the appeal of providing passive income, allowing you to literally earn money while you sleep.

What are the drawbacks of alternative investments?

As with any other investment, it's important to understand the drawbacks associated with new opportunities prior to committing your hard earned money.

Regulations: Alternatives are more difficult to value than publicly traded assets. The majority of transactions are non-public, making it challenging to benchmark assets against comparable transactions.

Illiquidity: Alternatives are less liquid than stocks or bonds. There are fewer buyers and sellers of alternative investments, meaning that it can take longer to convert an alternative investment back to cash at a price reflective of its market value.

Investment Horizon: Many alternatives have a longer investment horizon than stocks or bonds, with cash locked up for anywhere from six months to five years or more. This makes them impractical for those investors who would like to access their cash in the near to medium-term.

The flip side of these considerations is the low volatility and attractive returns that alternative investments offer. Less liquidity corresponds to lower volatility, and the lack of transparency around pricing creates opportunities for savvy investors to find attractive deals. For investors with a medium- or long-term investment horizon, alternative investments can be an excellent complement to a diversified portfolio.

What are examples of alternative investments?

Private Equity

Private equity is a broad category which encompasses all firms which make equity investments in private companies with the hopes of later selling them for a profit. Private equity investors raise money from institutional and private investors through a fund, which typically has a lockup period of five years or more and a high minimum investment, typically in the range of $250,000 and above.

Hedge Funds

Hedge funds invest in publicly traded securities but seek to beat the market using options, derivatives and leverage. Like private equity, hedge funds typically have high investment minimums (as well as high management fees), which puts them out of reach of many investors. Hedge funds also have restrictions on how soon and/or when investors are able to withdraw capital, although lockup periods are shorter than for private equity investments.

Gold

Gold is an alternative asset that is prized as a hedge against inflation and weakness in the U.S. dollar. Investors can gain exposure to gold in one of several ways, including direct ownership of the physical asset, purchasing an ETF that tracks the price of gold, and investing in gold options or futures. However, the price of gold has historically been volatile, making the asset class less appealing for investors with a low risk tolerance. Another downside is that gold offers no passive income streams to investors.

Real Estate

Like gold, real estate is an asset class that is accessible to nearly all investors. There are multiple avenues for gaining exposure to real estate, including direct investment in rental properties, investing in a real estate limited partnership, buying a publicly traded Real Estate Investment Trust (“REIT”) or investing in a crowdfunding platform that offers exposure to equity and/or debt investments in real estate. Equity investments in real estate offer the benefit of two streams of cash flow: periodic rental or dividend payments and growth through appreciation when the property is sold. The risk/reward profile of real estate investments varies greatly according to the property type and nature of the investment.

Farmland

Relative to other alternative investments, farmland is a newer opportunity, not because it hasn't been around but rather because of high barriers to entry. Farmland has historically been family-owned, and a lack of infrastructure has kept farmland out of reach for most investors. However, with a boom in land ownership transfers expected over the next decade and the introduction of innovative investment platforms like FarmTogether, farmland investments are now available to accredited investors. Farmland offers the benefit of investment in a real asset with intrinsic value. Similar to gold, farmland offers a hedge against inflation and is negatively correlated with the performance of the stock market. Unlike gold, however, the value of farmland is less volatile. Investors in farmland also receive the benefits of periodic lease payments, crop yield, and growth through appreciation of the underlying asset (i.e. the land).

Click here to see farmland's historical performance, visit our FAQ to learn more about investing with FarmTogether, or get started today by visiting ways to invest.

Disclaimer: FarmTogether is not a registered broker-dealer, investment advisor or investment manager. FarmTogether does not provide tax, legal or investment advice. This material has been prepared for informational and educational purposes only. You should consult your own tax, legal and investment advisors before engaging in any transaction.

Was this article helpful?