May 22, 2020

A Quick Comparison: Farmland vs. Real Estate Investing

Direct investments into farmland present a compelling opportunity; farmland offers stable returns on investment, low correlation to “traditional” assets like bonds and equities, and a hedge to inflation. Historically, investors have had limited access to farmland as an investment, since farmland, like commercial real estate (CRE), is a relatively illiquid market with high cost-to-entry. The emergence of crowdfunding platforms has minimized these former barriers-to-entry.

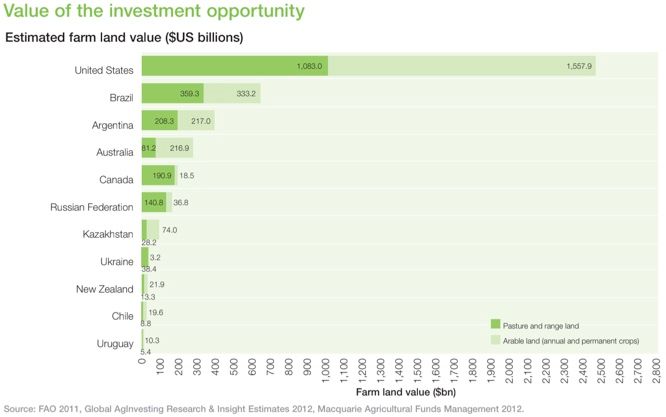

Farmland investment may seem like a foreign concept, even to those familiar with real estate investing. However, by applying similar frameworks from conventional real estate investing augmented by the expertise of our team, you can reap the benefits in your portfolio with access to the $2.5 trillion US farmland market.

Active v. passive

Both farmland and CRE investing usually require a longer (5+ year) time horizon. Conventional real estate does offer some shorter-term, typically high-risk/high-reward active options, like house-flipping, but we don’t see this in farmland.

In CRE, active investments are usually easier to envision doing entirely by yourself (i.e. being a landlord versus pruning and harvesting your own almond trees). You can hire someone to manage the property for you, becoming a more passive investor, and lowering your margins, but that may only make sense at scale and still requires expertise to select the right properties.

In regards to the passive end of the spectrum in CRE, you can buy shares in investment vehicles - REITs, ETFs, mutual funds - where a portfolio of properties will be selected and managed on your behalf. However, your investments are dictated by the portfolio manager’s approach and scope of the fund.

Farmland investing has the same active to passive options. However, it was until more recently that farmland has become a more easily accessible investment opportunity. Crowdfunding - new to the scene in 2012 - allows investors to select specific assets (like more active options) evaluated and managed by the expertise of a professional team (like more passive options). In regards to farmland, with an online investment platform, you can get the benefits of direct ownership without needing the agriculture expertise to choose the right deals or the scale to buy an entire farm.

Different types - risks & returns

Farmland, like conventional real estate, is not homogenous - there are a few different types with associated risks and potential for returns. You can categorize different types of farmland by what they’re used for, just as you would for CRE, giving you a sense of how market trends influence values.

Where CRE has multifamily, retail, office, hotel, and industrial, farmland has pastureland and different types of cropland. We separate cropland into annual crops - which consists of row crops and speciality crops - and permanent crops. Annual crops are just that, planted and cultivated each year. Row crops consist of the big grains and commodities (corn, soybeans, etc.), and annual specialty crops are mostly veggies. Permanent crops are different in that they take a few years to mature, with economic lives of 20+ years, some much longer.

Greater flexibility to adapt to market trends means less risk. An office building in a city with multiple industries, for example, can be rented out to different types of businesses, but a manufacturing facility is less adaptable. With farmland, crops planted annually allow farmers to consider consumer & price trends prior to deciding what to plant the following year (i.e. eliminating what wasn’t profitable). Row crops, like commodity grains, required for a multitude of uses (food, feed, etc.) often with some government protections, typically have lower margins with their more stable demand.

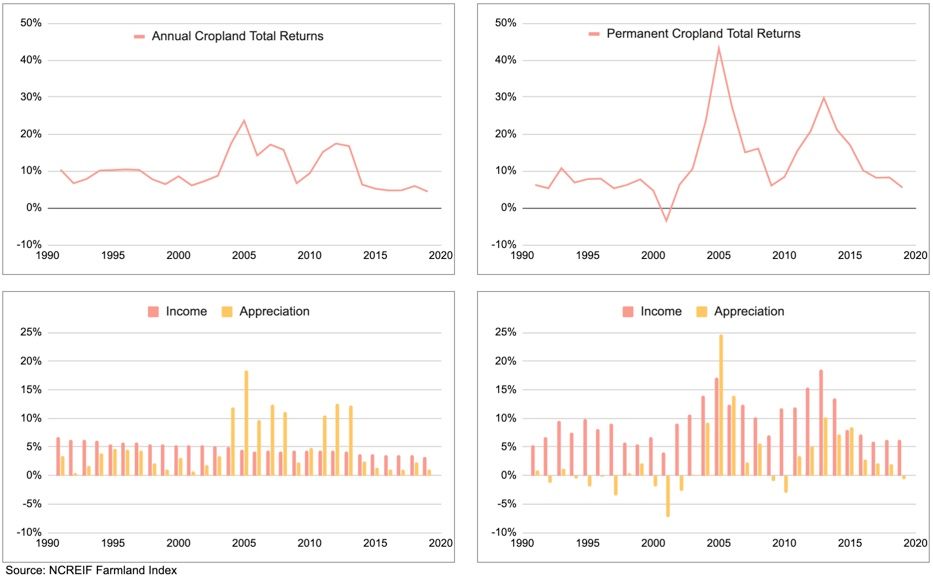

Permanent crops - which is where we invest most - are higher risk but can be higher return. Trees take multiple years to become economically viable, locking an owner into what’s planted or faced with the expensive decision to start over. That can mean low prices for producers when there’s oversupply, as is the current case for wine grapes, which is why we’re always looking at the market forces & trends when we’re buying mature trees or deciding what to plant for a new development. You can see the difference in return volatility between annual and permanent crops below, especially in the income-derived returns.

Location and quality are key

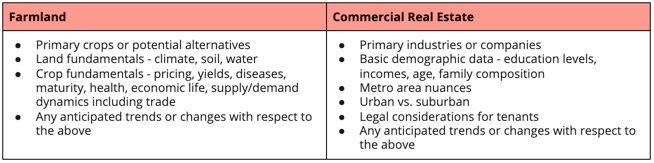

...but the factors you’re considering are different. You might see farmland included in a miscellaneous “land” category in real estate investing, but it’s more similar to a specialized type of CRE akin to industrial. As with any other real estate investment, location is key as it dictates how feasible different property types are, e.g. a high-tech, class A commercial office building won’t have sufficient demand in rural Oklahoma no matter how cheap it is to purchase or maintain. You can have an excellent property with great water and great soil, but if it’s in Montana and you want to grow lemons, you won’t get very far because the climate is wrong.

Our team applies an extensive due diligence process to any property we purchase. Below can give you a taste of what considerations go into evaluating location and quality:

Income streams

Real estate returns can be split into income and appreciation. Appreciation returns won’t be realized until the property is sold, which you can estimate by marking-to-market in the interim. Income is either rent or revenue. Rent is the norm in CRE with lease terms varying by industry.

Almost 40% of US farmland is rented - over 50% if you look at just cropland, excluding pastureland - which can mean collecting rental income as you would from any other type of tenant in real estate by leasing to an operator. For farmland specifically, there’s also revenue-sharing, or variable rent. This structure translates to a much lower fixed rental rate for the operator with a variable portion based on revenues. Both the owner and the operator earn more with the successful harvests (or less in a bad year).

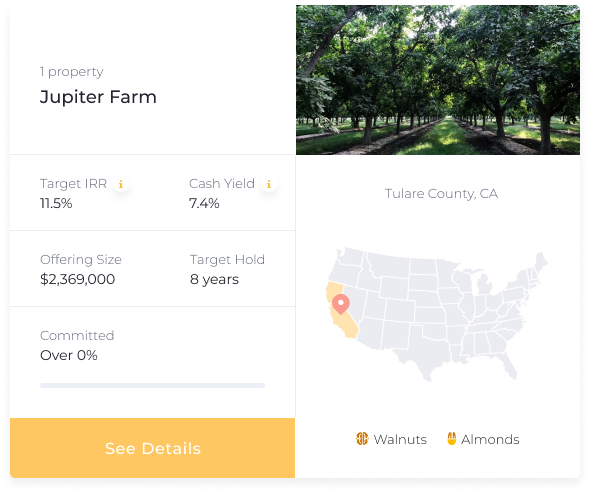

For example, in our own Jupiter Farm, we’re purchasing a walnut orchard whose yields will improve by ~20% over three years with additional investment into inputs from FarmTogether investors and improvements like better pruning from our operator. In a variable-rent model, we’ll both reap the benefits from our contributions to higher yields on the property. Furthermore, the yield data we’ll be able to provide when we sell will support a higher resale value.

Click here to see farmland's historical performance, visit our FAQ to learn more about investing with FarmTogether, or get started today by visiting ways to invest.

Disclaimer: FarmTogether is not a registered broker-dealer, investment advisor or investment manager. FarmTogether does not provide tax, legal or investment advice. This material has been prepared for informational and educational purposes only. You should consult your own tax, legal and investment advisors before engaging in any transaction.

Was this article helpful?