July 30, 2025

Farmland vs. Private Credit: Two Sources of Passive Income, One Structural Advantage

In today’s higher-for-longer rate environment, many investors are taking a fresh look at passive income alternatives. With traditional bonds yielding around 4.4%, below inflation-adjusted historic averages, and public equities exhibiting significant volatility without the support of meaningful dividends, investors are increasingly turning to private markets — particularly into two segments: farmland and private credit.

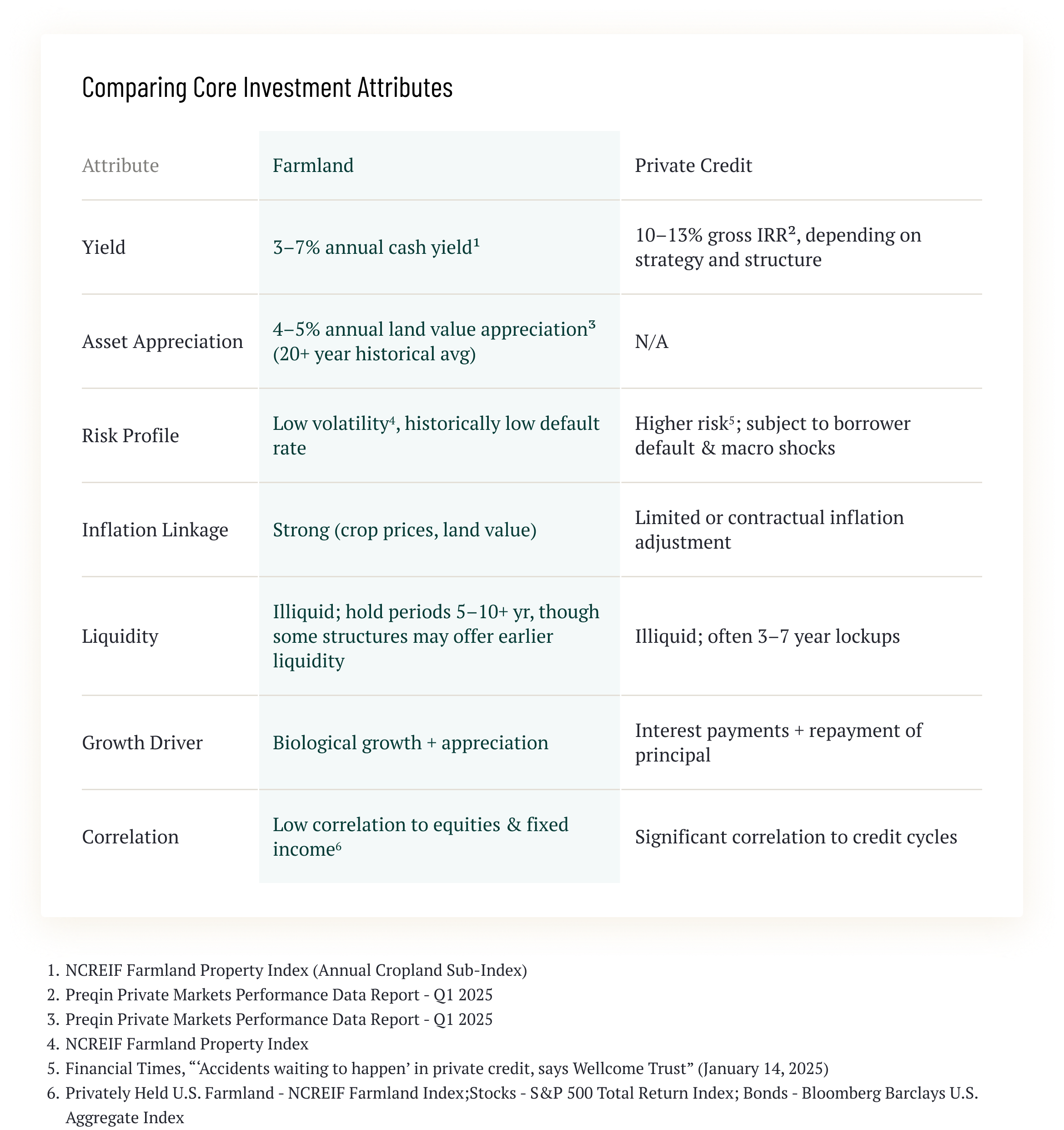

Both asset classes offer recurring income, but beneath the surface, their risk-return dynamics, inflation linkage, and capital preservation profiles diverge sharply. As investors weigh how to generate durable yield while managing downside risk, understanding these differences is critical.

Defining the Two Income-Oriented Alternatives

Private credit typically refers to non-bank loans made by private institutions to middle-market companies. These loans can range from senior secured debt to subordinated mezzanine capital and are often structured outside traditional credit markets. Investors are attracted by yields that outpace public fixed income, with recent vintages offering 10–13% gross IRRs depending on the strategy and leverage.

Farmland, by contrast, generates income through annual crop yields and rental payments from operators. U.S. farmland has produced stable, low-volatility returns historically, with income yields ranging from 3–7% depending on crop type and structure, alongside potential land appreciation.

What Makes Farmland Distinct

While both assets can provide passive income, farmland offers two key structural advantages: biological growth and land appreciation. Unlike credit, where returns are fixed and capped by loan terms, farmland benefits from natural productivity increases, and its scarcity has contributed to long-term valuation increases. Even in flat or inflationary environments, mature trees continue to produce harvests year after year and well-managed soil can maintain – or gradually improve – productivity over time.

Additionally, farmland’s value is inherently linked to inflation. Food prices — which are closely tied to the Consumer Price Index (CPI) — have historically risen in inflationary environments – boosting farm revenues and supporting land values. This linkage is organic, not contractual, and has contributed to farmland’s historical resilience during inflationary periods.

What’s Driving the Boom in Private Credit — and Its Risks

Private credit has exploded into a ~$1.5 trillion asset class, fueled by regulatory changes such as Basel III, which increased capital requirements and constrained traditional bank lending. As banks pulled back, private lenders stepped in — often with less oversight and faster capital deployment.

This growth has created opportunities, but also elevated risks. Structures are becoming more aggressive, with looser covenants, increased leverage, and greater exposure to economically sensitive borrowers. As capital has flooded into the space, concerns have emerged around underwriting discipline and the resilience of recent vintages in a tighter credit environment.

Farmland, by contrast, hasn’t changed. The same forces that governed value 30 years ago — crop yield, soil health, regional climate — persist today. That consistency is increasingly appealing in an environment where new credit vintages may be tested by tightening conditions.

How They Can Work Together in a Portfolio

Farmland and private credit don’t have to compete — they can complement. Private credit can serve as a yield-enhancer within an alternatives allocation, particularly in short-duration or floating-rate strategies. Farmland, by contrast, acts as a stabilizer: it is less correlated to financial markets, underpinned by essential goods, and historically resilient through cycles.

When combined thoughtfully, the two may provide investors with a more diversified and durable income stream — balancing farmland’s inflation protection and capital preservation with the higher upside potential of private credit.

The Bottom Line

In the search for income, not all passive strategies are created equal. While private credit has gained momentum, it also carries rising risks amid rapid growth and looser underwriting. Farmland offers a slower, steadier path — one tied to biological growth, inflation-linked assets, and long-term stewardship.

For investors aiming to construct durable, income-producing portfolios in a high-rate world, understanding these distinctions — and how to allocate between them — is critical.

Click here to see farmland's historical performance, visit our FAQ to learn more about investing with FarmTogether, or get started today by visiting ways to invest.

Disclaimer: FarmTogether is not a registered broker-dealer, investment advisor or investment manager. FarmTogether does not provide tax, legal or investment advice. This material has been prepared for informational and educational purposes only. You should consult your own tax, legal and investment advisors before engaging in any transaction.

Was this article helpful?