April 25, 2019

Cropland: What’s It Worth and How Is It Valued?

This article is the first in a series for investors who are potentially interested in owning or investing in land, specifically farmland. We’ll start at the top with the big questions and work our way down to more detail in later posts. Throughout, if you want to learn more about any of this or how we do it, please don’t hesitate to call or write to us.

Land Distribution in the US

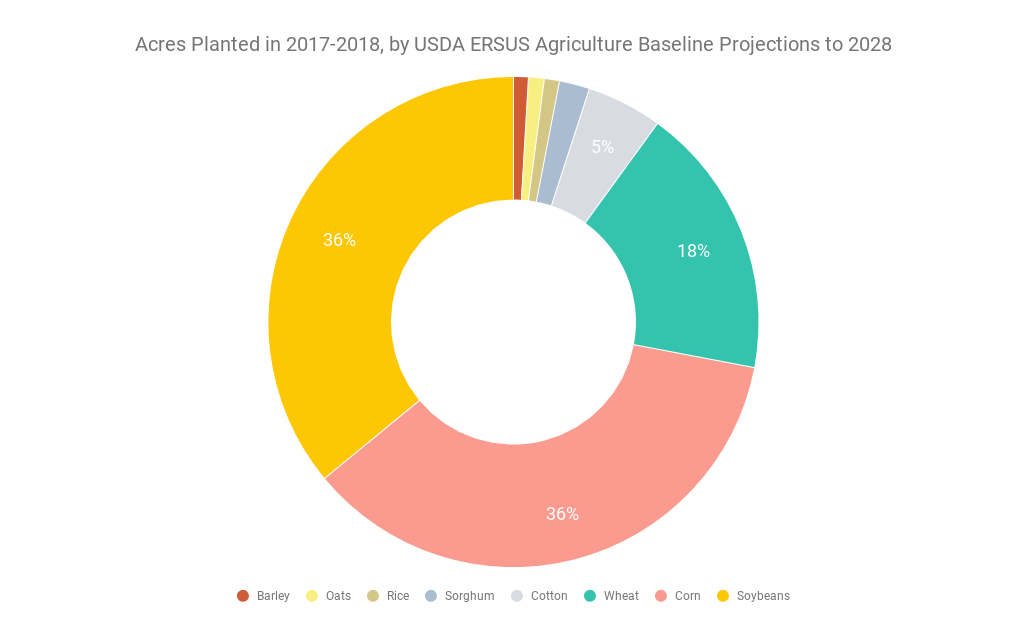

About 40% of all land in the United States is in farmland uses, totalling about 900 million acres. Not quite half of that is in permanent pasture. About 31% of farmland is in cropland, which consists predominantly of row crops like corn, soybeans, wheat, and cotton in terms of acreage, with less than 10% in fruit, nuts and vegetable production. In this article, we’ll focus on the row crops.

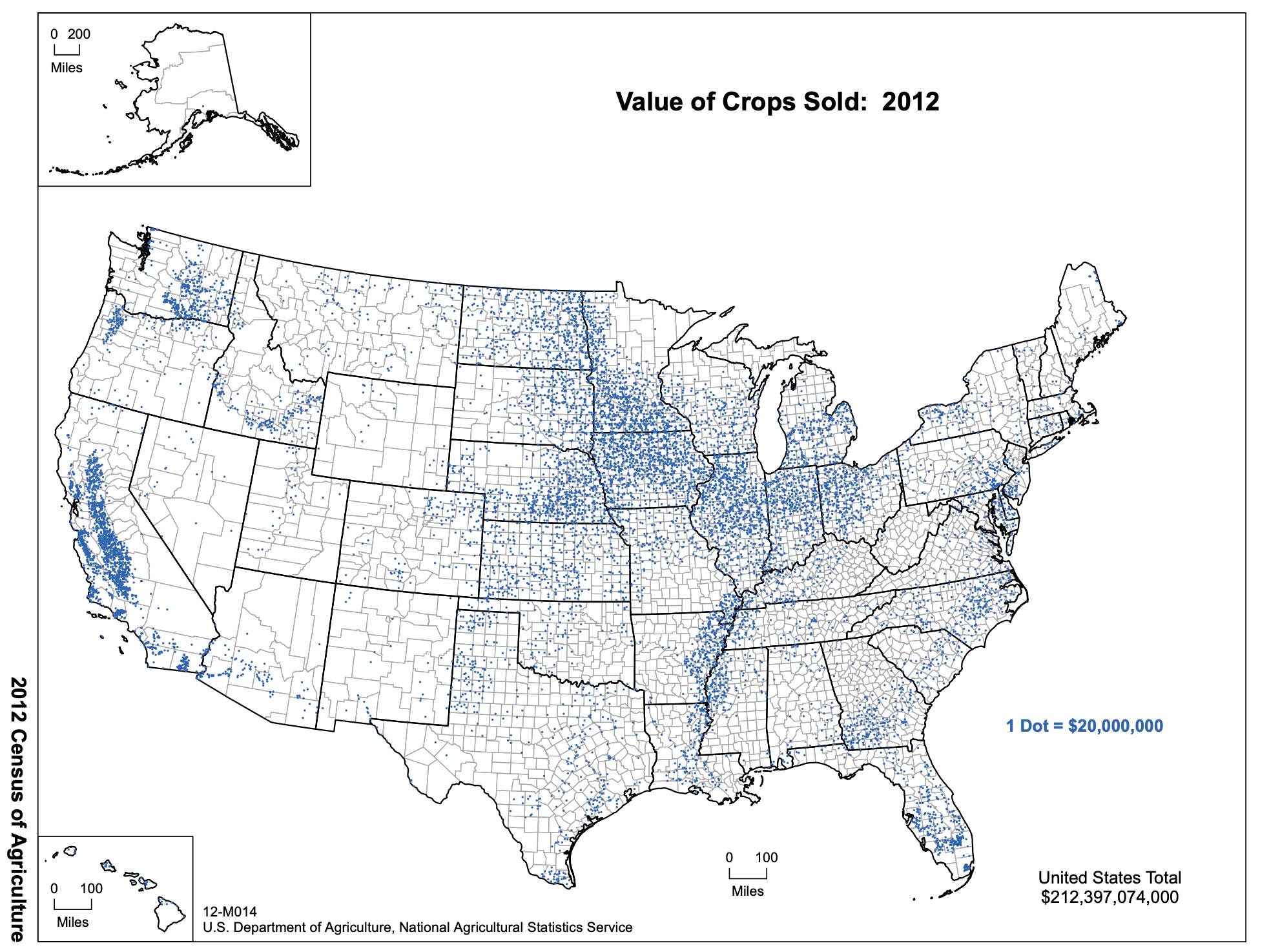

Most row crop production is in the Midwest and California:

How are Farmland Acres Valued across the US?

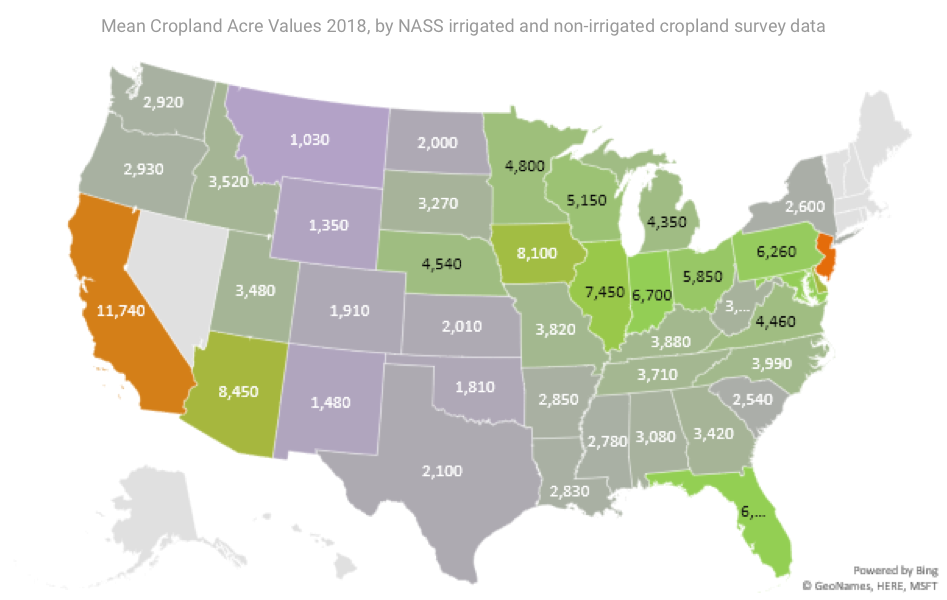

The value of an acre of cropland varies widely depending on location and crop, as you might expect. It might average as high as $12,000 in California or New Jersey, while cropland in Montana could be found for about $1,000 per acre. These are averages for wide-ranging values of land. Within Illinois, for instance, you can find land for $5,000 per acre while the flat black soils in Central Illinois can command up to $15,000 per acre today.

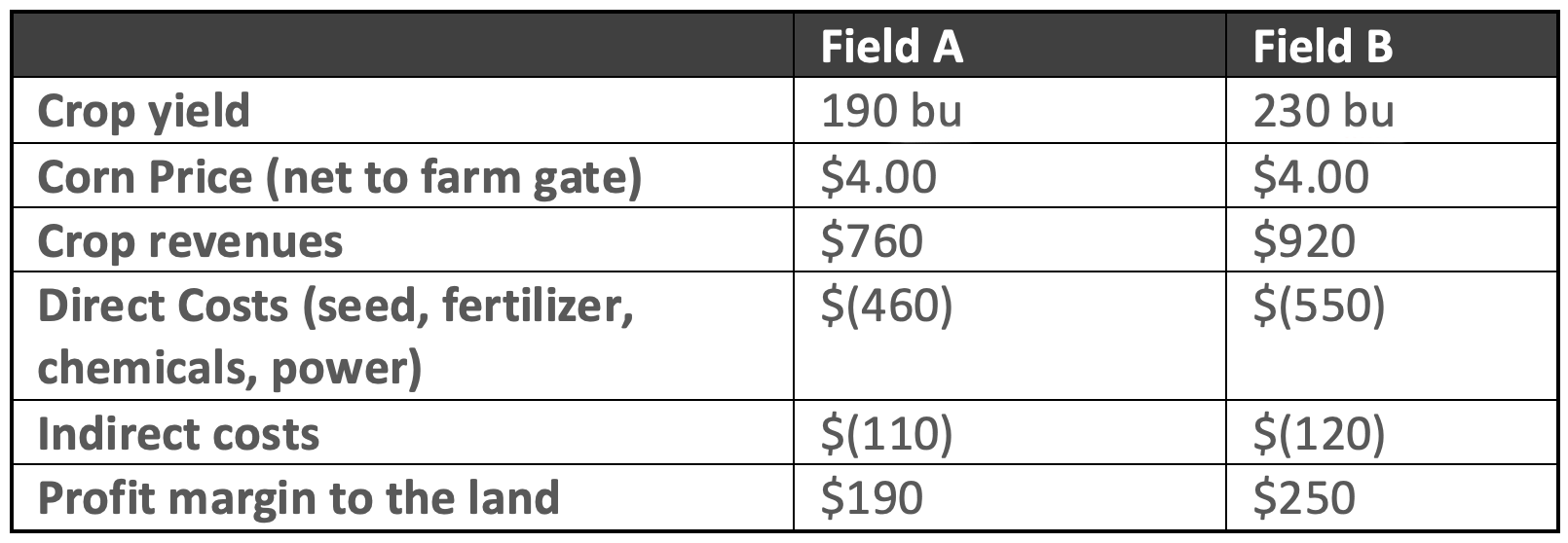

Aside from any structures like buildings, wind turbines, solar panels, or storage bins, what drives the differences in cropland value in any one area? In a word: production economics. Okay, that’s two words, but the point is that the value of one field versus another is directly related to the revenues minus the expenses associated with that field. Here’s a simple example for two corn fields:

In this simplified example, Field B would be worth more than Field A. How much more? Each buyer has their own way of valuing an asset, which is true in any business, but generally, the long-term and stable nature of farming lends itself to perpetuity theory. The valuation of a perpetual fixed-income asset is the cash flow (interest payment) divided by a discount rate. That discount rate is called the capitalization rate. In the Midwest, capitalization rates for high-quality cropland tend to be around 2.5% these days. So, in the above example, Field A would be worth $7,600 while Field B would cost $10,000 at a 2.5% cap rate.

Capitalization rates for cropland

Capitalization rates are influenced by many factors (long-term interest rates, insurance programs, and the supply and demand for land, to name a few). One thing that traditionally supports land prices is a paucity of supply on offer for sale. There are not many forced sales (most farm ground has no debt on it), and there is a tremendous legacy value for most who own it. This is something under-appreciated in the business – legacy values are huge and important. Land owners form attachments to their land. When land is passed from one generation to the next it carries a history with it that families value. The vast majority of farmland is owned by families, not corporations or institutions. If there were no legacy value we’d see more land on the market. But that’s not to say that millions of land owners are unhappy with their investments. Legacy value or not, they’d dump their land if it didn’t work well in their portfolios.

Crop insurance programs also help stabilize and put a floor under farm economics, seed genetics have been improving yields steadily in row crops, while making them more drought resistant, and low interest rates tend to keep cap rates down. All these factors contribute to firming up land values.

Note that the value of the land is derived from expectations of the buyer, which can be based partly on historic data, but many look ahead at what can be produced more than what was. The first thing cropland buyers look at is the soil types in the field. We’ll go into the subject later in this series, so for now, suffice it to say that soil type can be a proxy for yield expectations. The official site for understanding soil classifications and finding maps of soil types in your fields can be found at Web Soil Survey USDA service. As with many government sites, this tool can be a bit difficult to use, so a slick tool that is free to use (so far) is provided by AcreValue, a unit of Granular (now owned by DuPont). Take the value estimates on AcreValue with a grain of salt but note the productivity numbers. Soil productivity data is usually summarized by an index number (PI). They’re calculated differently in each state, but what’s important is how different parcels relate to each other.

Still, sometimes nearby parcels with similar PI can sell for very different prices. Other factors accounting for differences in parcel value can include development potential (potential development or energy potential like wind and solar), shape of the parcel (rectangles are efficient for equipment), access to it, water (too much or too little), local crop prices (basis spreads), any improvements like buildings or storage facilities, and emotional factors like outbidding a troublesome neighbour. Each piece of ground is unique, and the value of it is often in the eyes of the beholder.

Here at FarmTogether, we apply a thorough process with quantitative and qualitative factors such that we can be confident that what’s available on FarmTogether’s platform are only quality properties with desirable risk-adjusted returns.

If you want a more detailed explanation of our due diligence process, read this blog post.

Click here to see farmland's historical performance, visit our FAQ to learn more about investing with FarmTogether, or get started today by visiting ways to invest.

Disclaimer: FarmTogether is not a registered broker-dealer, investment advisor or investment manager. FarmTogether does not provide tax, legal or investment advice. This material has been prepared for informational and educational purposes only. You should consult your own tax, legal and investment advisors before engaging in any transaction.

Was this article helpful?