October 20, 2020

COVID-19's Unprecedented Impact on Stock Market Volatility

2020 has been a year of unparalleled volatility for investors. In February, the record-setting 11-year bull market finally came to an end as the COVID-19 pandemic ground the global economy to a halt. Stock prices crashed and volatility indicators skyrocketed. Although stocks have now recovered their pre-COVID highs, these elevated valuations mask the extent to which COVID-19 has fundamentally changed volatility in the equity markets.

COVID-19 has had a major and unprecedented impact on the stock market

The impact of COVID-19 on the stock market is unlike anything in recent memory. As the chart below illustrates, markets have not been this choppy since Black Monday in 1987 — the volatility in 2008 - 2009 during the Global Financial Crisis wasn’t even close. Prior to 1987, the stock market had not seen comparably volatility since the crash in 1929 and the Great Depression in the 1930s.

Notably, none of these volatility events were related to a global health crisis. Recent epidemics, such as the Ebola outbreak in 2015 and the SARS epidemic in 2003, had virtually no impact on the US stock market. Even the Spanish Flu pandemic in 1918, which killed as many as 50 million people worldwide, caused minimal volatility in financial markets.

So what makes COVID-19 so different? Researchers at the Kellogg School of Management at Northwestern University have offered a couple of theories.

One obvious explanation is the severity of the COVID-19 pandemic compared to other epidemics. It is an understatement to say that the pandemic has had a major impact on both global health and the global economy. However, this isn’t the full story. The Spanish Flu was similarly deadly but failed to have anywhere near the same impact on markets.

That being said, there are many ways in which 2020 is very different from 1918. Information is more readily available and news travels much more quickly. Some of the recent uncertainty in financial markets was caused by media-induced panic, which led investors to overreact.

Another explanation put forward for the disproportionate impact of COVID on financial markets is that the world economy is significantly more interconnected than it was 100 years ago. Travel is faster and easier, and cross-border travel, especially in Europe, is more common. Additionally, many companies depend on global supply chains, which have been disrupted by differing government responses to COVID. This is exacerbated by the shift to just-in-time inventory models, which have less built-in redundancy.

Finally, and perhaps most importantly, has been the policy response to COVID-19. The social distancing and containment policies adopted to a greater or lesser extent across the globe have led to a sudden decrease in the production of goods and services. Because the containment measures adopted today were so much more severe than any similar measures in 1918, researchers believe this is the most likely explanation for why COVID has disrupted equity markets to such an unprecedented degree.

The impact of COVID has not been uniform across industries

Although the stock market in the US has effectively recovered, these elevated valuations are deceiving — they conceal the fact that the impact of COVID-19 on different industries has not been uniform.

Any discussion of the stock market must keep in mind that much of the recent outperformance has been driven by a handful of “mega-cap” tech stocks. Facebook, Apple, Amazon, Alphabet and Microsoft, the so-called “FAAAM” stocks, account for more than 25% of the S&P 500 (as well as a disproportionate share of other US equity indices). Much of the recent upward momentum in the S&P 500 has been driven by the performance of these five companies. Strip them out, and the year-to-date growth of the S&P 500 has been much more modest, as can be seen below.

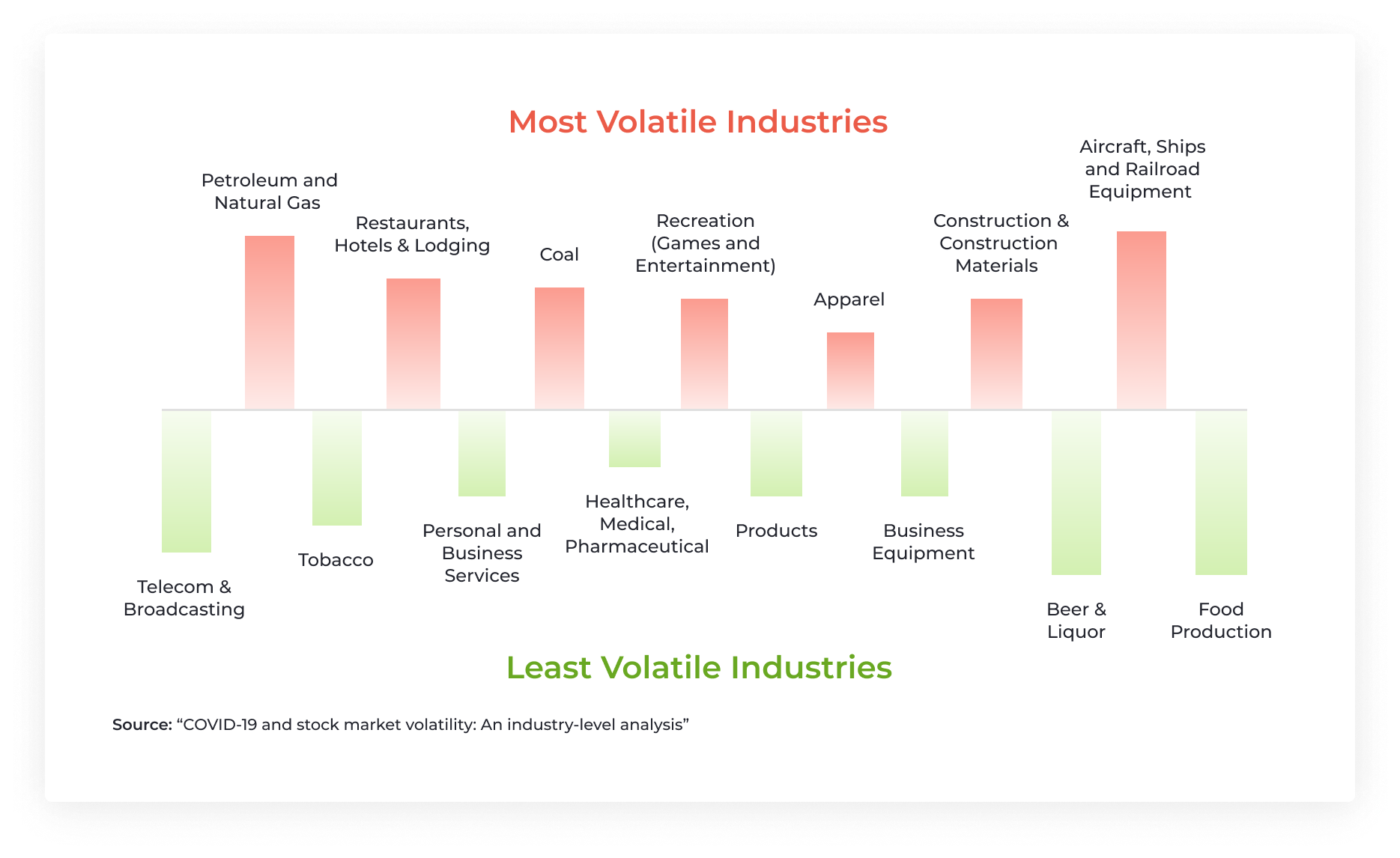

More than total performance, COVID-19 has fundamentally changed the volatility of publicly traded companies. All industries are more volatile now than they were in the pre-COVID environment; however, some industries have been impacted more than others. Researchers at Brooklyn College have found what many investors may have already guessed: the industries experiencing the most volatility year-to-date are those most impacted by supply and/or demand shocks related to COVID. Petroleum and natural gas top the list, but industries such as apparel, restaurants and transportation have also been severely impacted.

Conversely, the sectors with the least volatility in the current environment are those that have been least disrupted by social distancing measures and government policies designed to slow the spread of the virus. It should come as no surprise that these industries include food production, healthcare and beer & liquor.

Source: “COVID-19 and stock market volatility: An industry-level analysis”

S&P Market Intelligence found similar results. S&P examined the probability of default across industries, or the likelihood that a company will default on its debts. Not surprisingly, the same industries experiencing the greatest increase in stock price volatility are those most likely to default. S&P found that petroleum and natural gas companies, restaurants and airlines were three of the top five industries most impacted by COVID-19.

While the probability of default is lower than its March high, which coincided with the peak of the VIX Volatility Index, overall levels are still higher than they were pre-COVID.

How can investors navigate uncertainty in the post-COVID world?

All this goes to show that the COVID-19 pandemic has fundamentally changed the stock market, at least for the foreseeable future. With the universal increase in volatility across sectors, it is more important than ever for investors to have a smart strategy for their investments.

First and foremost, diversification is crucial. Having a diversified portfolio is the single best way for investors to mitigate risk and preserve wealth. Some diversification can be achieved by buying ETFs or mutual funds; however, as the past ten months have illustrated, these products are not safe from market-wide shocks. Many investors diversify into lower-risk investments such as bonds as a hedge against declines in the stock market. With interest rates near zero for the foreseeable future, though, these products are less and less appealing.

In order to achieve both diversification and a healthy return on investment, many savvy investors have added alternative investments to their portfolios. Alternative investments have the advantage of being uncorrelated to public markets, meaning they preserve their value through stock market fluctuations. Additionally, most alternative assets are less volatile than equities, an appealing feature in today’s whiplash-inducing market. The right alternative investment can also deliver above-market returns and passive income.

Farmland: A historically low-volatility asset

For a low-volatility asset to hedge against inflation and deliver superior returns, investors should consider farmland. Over the past 20 years, farmland has been less volatile than both stocks and commercial real estate. Farmland also delivers real return on investment. Between 1998 and 2018, farmland delivered ~10% total annual returns (income and price appreciation). Finally, farmland’s scarcity value makes it an effective hedge against inflation.

FarmTogether’s technology-enabled investment platform allows accredited investors to access a wide range of well-vetted investment opportunities in US farmland.

Click here to see farmland's historical performance, visit our FAQ to learn more about investing with FarmTogether, or get started today by visiting ways to invest.

Disclaimer: FarmTogether is not a registered broker-dealer, investment advisor or investment manager. FarmTogether does not provide tax, legal or investment advice. This material has been prepared for informational and educational purposes only. You should consult your own tax, legal and investment advisors before engaging in any transaction.

Was this article helpful?