July 07, 2020

Farmland vs. Gold - A Comparative Analysis

Gold is often considered a safe haven investment. Its value never seems to dip too far, and growth is almost assured. For these reasons among others, many savvy investors choose to stake their claim in the gold market. Such a stable yet value-generating investment is hard to come by, which is part of the reason why gold has remained so valuable to stock brokers and personal investors alike.

But, one investment opportunity may be coming for gold’s crown: farmland.

Over the past two decades, farmland has proven itself a strong adversary to the ever-growing gold market in the United States. With lower volatility and higher returns over the past few decades, farmland may just be replacing gold in many investors’ portfolios.

To help you understand how these two stack up, we’re going to perform a comparative analysis of gold and farmland on a few key factors. These factors are major reasons why investors choose these options for their portfolios, and may hold the answer to the ultimate question: which should you trust?

Stability: Gold vs. Farmland

Gold

The price of gold has risen nearly 600% since 2000. For this reason, many investors see gold as the “gold standard,” pardon the pun, of stable, middle range risk-level portfolios. Gold has some market volatility that doesn’t bode well for low-risk investors.

Gold has a broad range of applications and uses. From jewelry to your smartphone, gold can be found somewhere in most industries. However, not all applications are considered “necessary.” In fact, many are considered frivolous. Due to this, gold’s “intrinsic” value is lacking when compared to other, similar investment opportunities.

Farmland

Farmland creates a return on its value every time a farmer sells the resources produced by the land. Basically, the land itself is valuable, and the potential value of the crop (depending on what’s being grown, how bountiful the yield is per season, among other factors), adds additional income and return on the investment.

Adding to this stability is the fact of what farmland produces: food. People need to eat. Therefore, many experts believe that farmland is a much more stable investment than gold in that no one can get around the need to feed a population. Many of these same experts argue that gold is a more frivolous product in its jewelry applications, while technologies such as our smartphones are much more easily tossed aside than our dinner plates.

In the long term, this makes farmland a much more stable investment than gold. While the volatility is lower, crop yields can provide a ton of additional income on your investment from year to year.

Returns and Inflation Hedging

Gold

As the buying power of money decreases over time, better known as inflation, the value of investments generally decreases along with it. This is why stockbrokers and investors look for opportunities that negate the effect of inflation, and sustain the buying power of their funds over time. This is known as “inflation hedging.”

Gold is an inflation hedge. Historically, as the purchasing power of the dollar decreases, the value of gold increases.

However, gold’s status as a luxury good means that investments aren’t necessarily “recession proof.” During an economic crisis, people don’t buy jewelry or other things that cost a lot but don’t mean as much as food, water, etc. So, while gold is a hedge against inflation, it is not resistant to other, unforeseen macroeconomic shifts.

But, some investments are.

Farmland

Unlike gold, farmland produces cash income as investors hold it in the form of crops or rent: better seasons mean better returns for investors.This value varies, but it adds another layer of profitability on top of an initial investment in farmland.

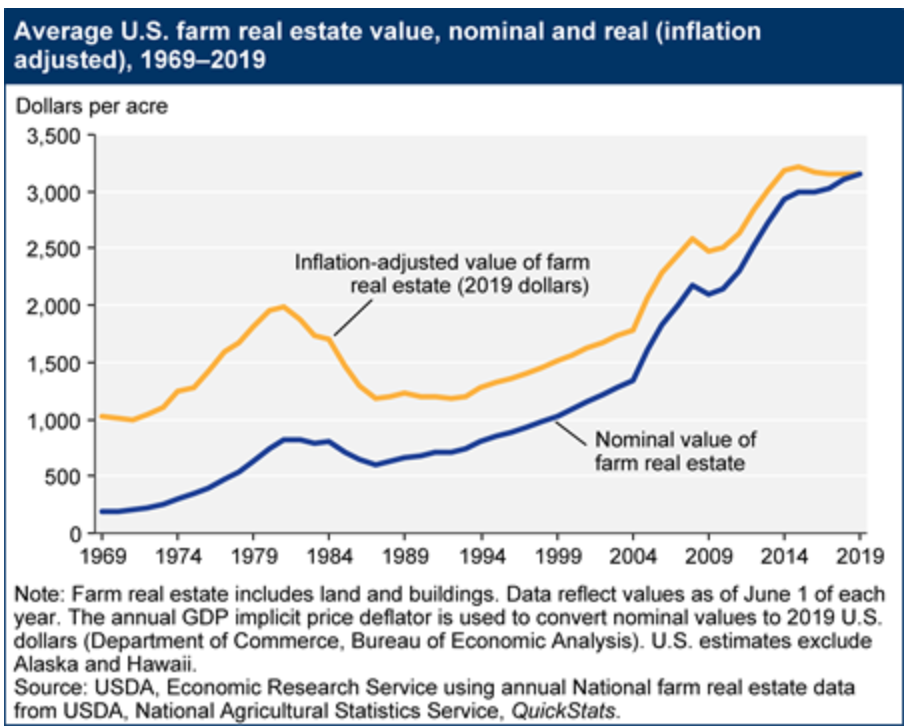

US farmland is in limited supply, actually decreasing marginally each year. That said, the simple fact remains: people need to eat. In an economic calamity, in a “golden age,” during times of war and peace, food is essential. Farmland is essential. In this sense, many investors see farmland outpacing gold in its ability to keep up with inflation over the next few decades.

Farmers are constantly being challenged to yield “more with less.” Arable land is in limited supply. So, with less land, farmers are looking to increase their yields through technology and innovative agricultural practices. As these efforts become more affordable and prominent, investors may see higher yields and greater profits, in addition to their investment’s appreciation.

How do I invest?

Assuming we’ve convinced you of farmland as a great investment opportunity, you’re probably wondering how you can get your hands on some.

With FarmTogether, investors have the option of Crowdfunded Farmland Offerings with low minimums, and low fees that are simple to understand, and Sole Ownership Bespoke Offerings for those individual investors looking for sole ownership of farmland.

Click here to see farmland's historical performance, visit our FAQ to learn more about investing with FarmTogether, or get started today by visiting ways to invest.

Disclaimer: FarmTogether is not a registered broker-dealer, investment adviser or investment manager. FarmTogether does not provide tax, legal or investment advice. This material has been prepared for informational and educational purposes only. You should consult your own tax, legal and investment advisors before engaging in any transaction.

Was this article helpful?